Finding out how much car insurance costs is often the first step in protecting your vehicle and yourself on the road. It’s not a one-size-fits-all answer though, and several factors play a role in determining your premium. This article will delve into those factors and equip you with the knowledge to navigate the world of car insurance costs.

Factors Affecting Car Insurance Costs

Several factors affect how much you’ll pay for car insurance. Understanding these factors can help you manage your expenses and find the best possible deal.

Your Driving Record

Your driving history is a major factor. A clean record with no accidents or traffic violations demonstrates lower risk, which translates to lower premiums. Conversely, accidents and tickets can significantly increase your insurance costs.

The Car You Drive

The type of car you drive plays a significant role in your insurance premiums. Sports cars and luxury vehicles are typically more expensive to insure due to their higher repair costs and increased risk of theft. Safer, more economical cars usually command lower insurance rates.

Your Location

Where you live matters. Urban areas with high traffic congestion and crime rates often have higher insurance costs than rural areas. Your zip code plays a significant role in your insurer’s risk assessment.

Your Age and Gender

Statistically, younger and less experienced drivers are more likely to be involved in accidents. Therefore, they often pay higher insurance rates. Gender can also play a factor, with young men typically paying more than young women.

Your Coverage Level

The level of coverage you choose directly impacts your premium. Liability-only coverage is the minimum required by law in most states and offers the lowest premiums, but it only covers damages to others in an accident you cause. Comprehensive and collision coverage provide more extensive protection, including damage to your own vehicle, but they come with higher premiums.

How to Get Cheap Car Insurance

Now that you know the factors affecting cost, let’s look at ways to save money on car insurance.

Compare Quotes

Don’t settle for the first quote you receive. Comparing quotes from multiple insurance providers is essential for finding the best deal. Online comparison tools can simplify this process.

Maintain a Good Credit Score

Believe it or not, your credit score can impact your insurance premiums. Insurers often view those with good credit as more responsible and less likely to file claims.

Bundle Your Policies

Many insurance companies offer discounts for bundling multiple policies, such as auto and home insurance. This can be a significant way to save money.

Take a Defensive Driving Course

Completing a defensive driving course can sometimes lead to a discount on your car insurance premiums. Check with your insurer to see if they offer this incentive.

Ask About Discounts

Don’t be afraid to ask your insurance provider about any available discounts. Some companies offer discounts for students, military personnel, and members of certain organizations.

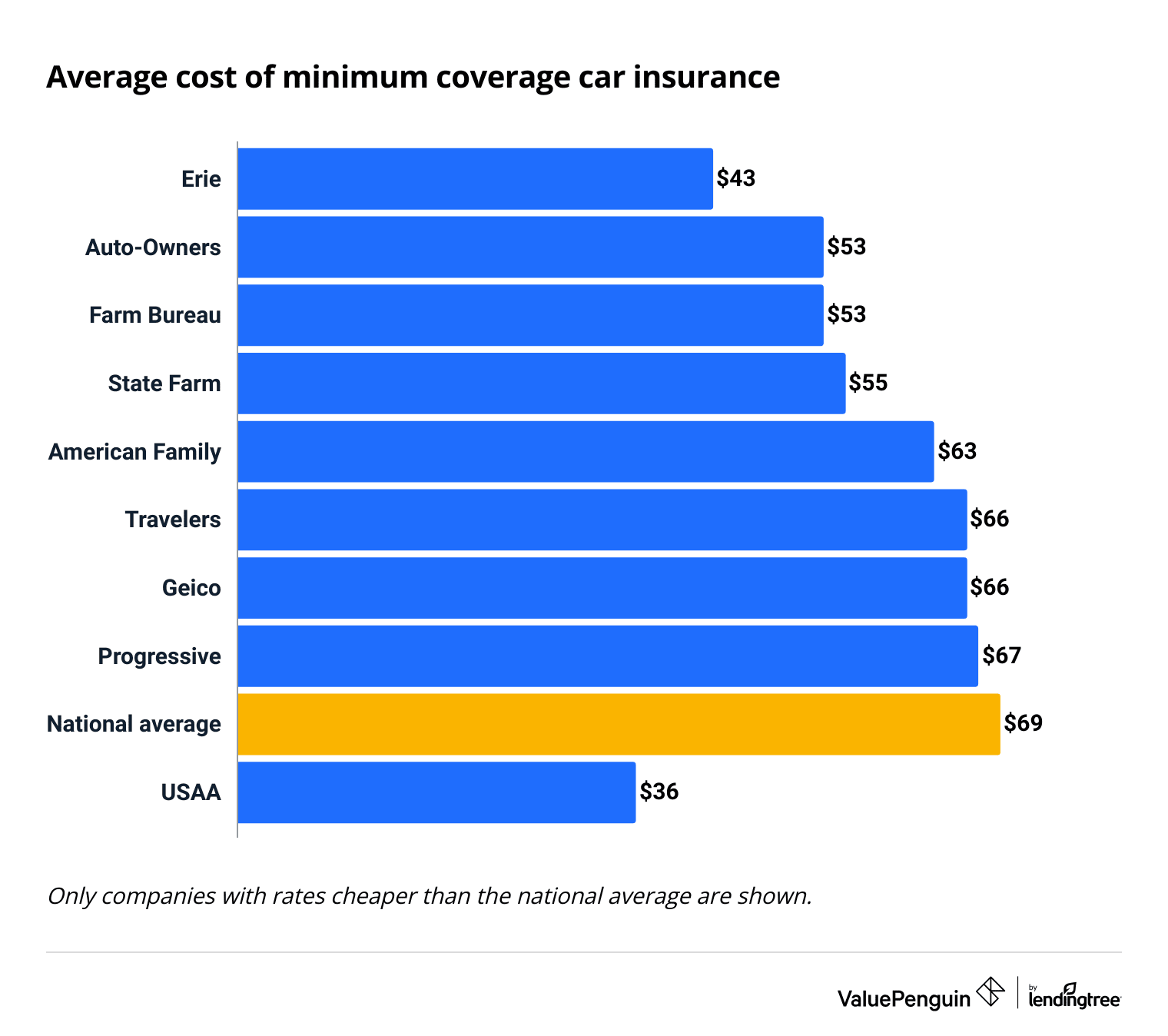

What is the Average Cost of Car Insurance?

Pinpointing an exact average cost is difficult because of the numerous variables. However, you can expect to pay anywhere from a few hundred to a couple of thousand dollars annually.

“Shopping around and comparing quotes is the single most important step in getting affordable car insurance,” advises Jake Thompson, Senior Insurance Analyst at AutoQuote Solutions.

How to Get a Car Insurance Quote

Getting a car insurance quote is easier than ever. You can obtain quotes online, over the phone, or through an insurance agent. Be prepared to provide information about yourself, your driving history, and the car you want to insure.

“Don’t forget to be upfront about any accidents or tickets on your record. Honesty is key to getting an accurate quote,” adds Maria Rodriguez, Lead Insurance Specialist at InsureWise.

Conclusion

Understanding how much car insurance costs and the factors that influence it empowers you to make informed decisions. By comparing quotes, maintaining a good driving record, and taking advantage of available discounts, you can secure the right coverage at a price that fits your budget. Remember to shop around and ask questions – your wallet will thank you.

FAQ

- What is liability insurance? Liability insurance covers damages you cause to others in an accident.

- What is comprehensive insurance? Comprehensive insurance covers damage to your car from events like theft, vandalism, or natural disasters.

- What is collision insurance? Collision insurance covers damage to your car from accidents, regardless of who is at fault.

- How often should I compare car insurance quotes? It’s a good idea to compare quotes annually or when your circumstances change.

- Do I need car insurance if I own my car outright? While you may not have a loan requiring it, most states legally mandate car insurance.

- Can I get car insurance with a DUI? Yes, but your rates will be significantly higher. Specialized insurers handle high-risk drivers.

- What is an insurance deductible? It’s the amount you pay out of pocket before your insurance coverage kicks in after an accident.